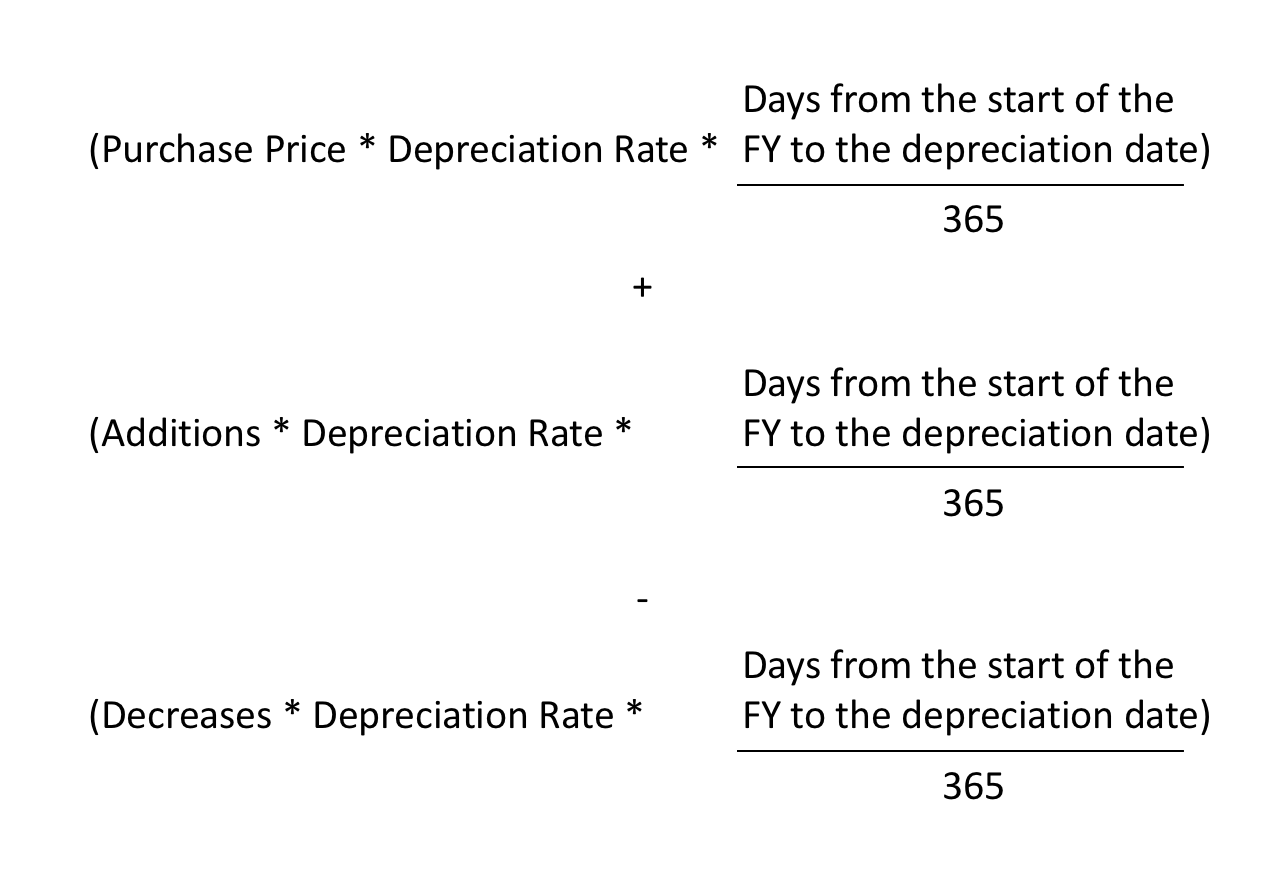

Prime cost method depreciation formula

Business vehicle depreciation is a Prime cost. Depreciation is calculated using the formula given below.

Recording Depreciation Part Way Through The Year Simple Fund 360 Knowledge Centre

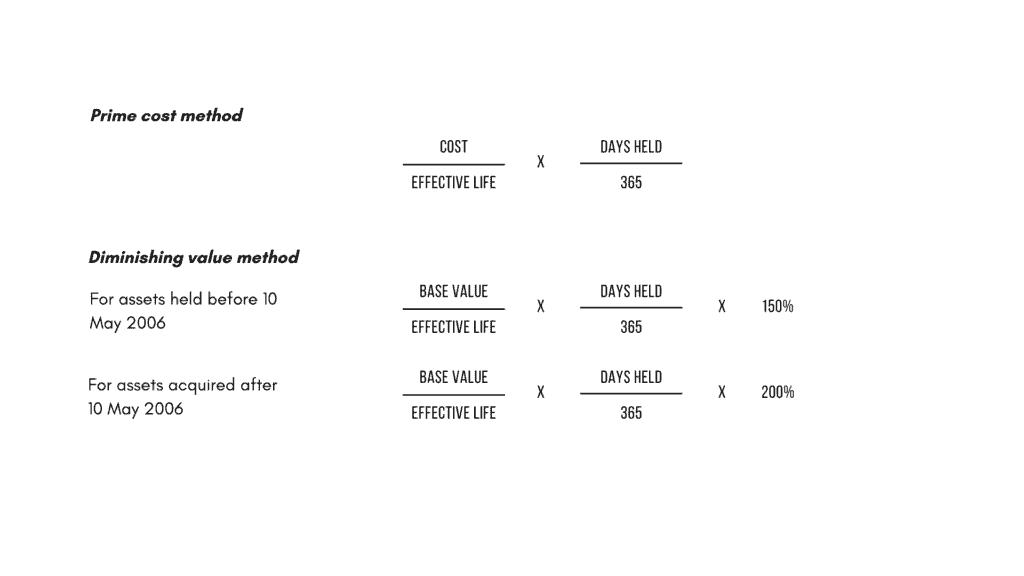

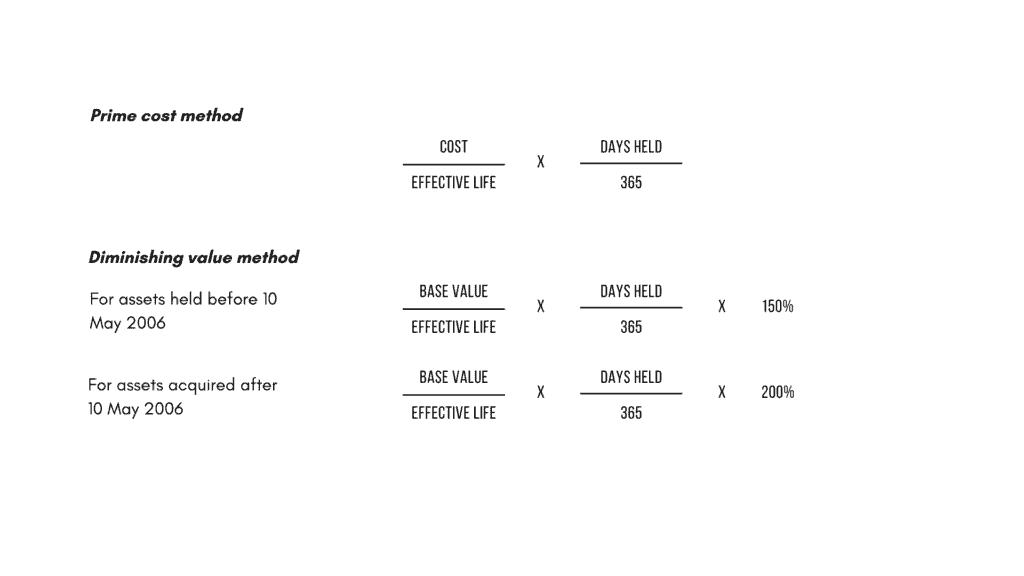

Assets cost days held365.

. If the cost of an asset is 50000 with an effective life of 10. Prime Cost Depreciation Method This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following. The prime cost to produce the table is 350 200 for the raw materials 150 in direct labor.

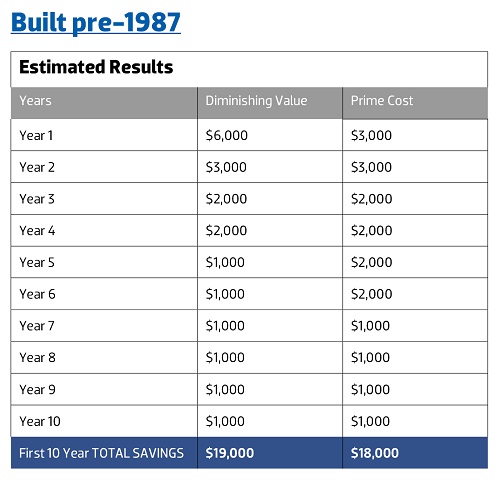

To generate a profit the tables price should be set above its prime cost. This method assumes the life of a vehicle in order to calculate either prime cost or Calculating depreciation. The remaining depreciation claim of 521 for the diminishing value method or 212 from the prime cost method after fifteen years would be claimed over the balance of the life of the.

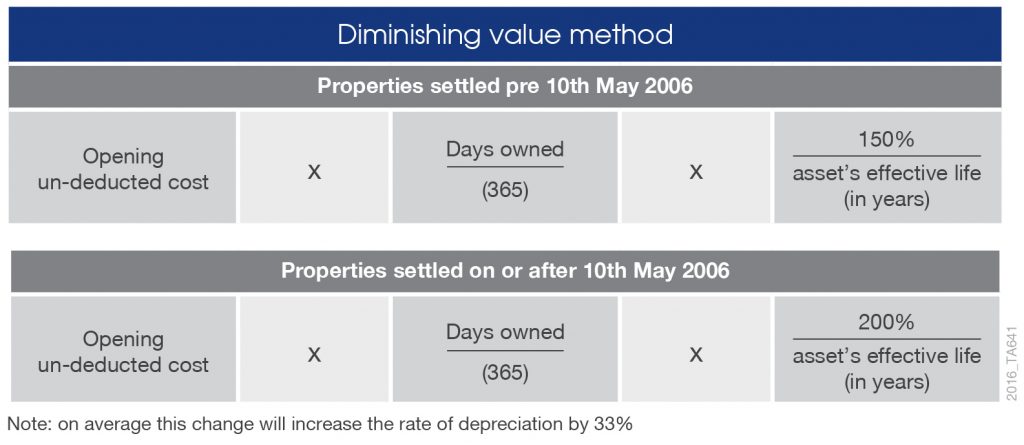

22 Diminishing balance or Written down. 2 Methods of Depreciation and How to Calculate Depreciation. Prime cost straight line and diminishing value methods In most cases you can choose to use either.

Unit of Production Method. The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life. View Depreciation Methodsdocx from BUSINESS 5912 at Academies Australasia College.

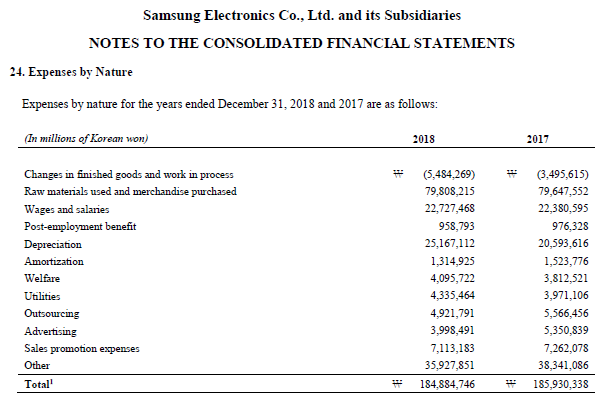

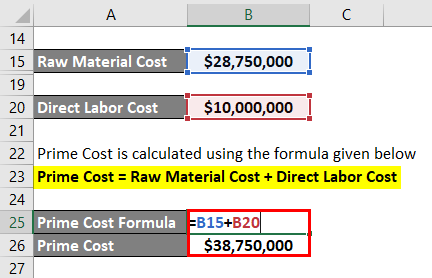

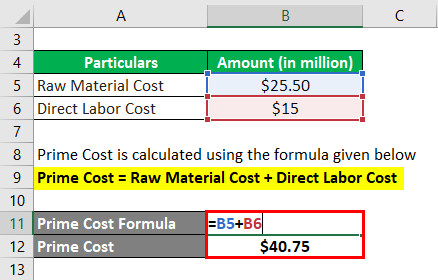

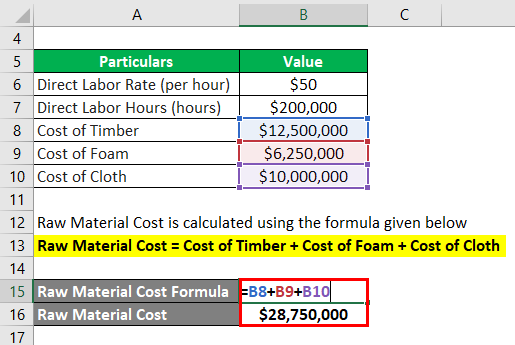

Depreciation 330000 in year 1 and 2. Formula Prime cost Direct materials cost Direct labor cost This formula shows that prime cost is the sum of all the production costs those that are directly incurred relative. Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its.

Depreciation Asset Cost Residual Value Life-Time. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Under the prime cost method also known as the straight line method you depreciate a fixed amount each year based on the following formula.

21 Fixed Installment or Equal Installment or Original Cost or Straight line Method.

Diminishing Value Vs The Prime Cost Method By Mortgage House

Working From Home During Covid 19 Tax Deductions Guided Investor

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Cost Formula Calculator Examples With Excel Template

Prime Cost Formula Calculator Examples With Excel Template

Depreciation Yip

Prime Cost Formula Calculator Examples With Excel Template

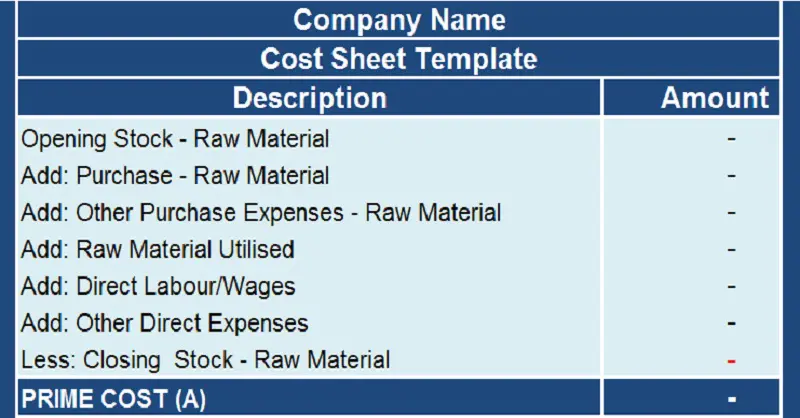

Download Cost Sheet With Cogs Excel Template Exceldatapro

Prime Cost Formula Calculator Examples With Excel Template

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Costs Meaning Understanding Example The Difference Between Prime Costs And Conversion Costs Limitations Of Using Prime Cost Commerce Achiever Commerce Achiever

Prime Costs Definition Formula Explanation And Example Wikiaccounting

Prime Cost Meaning Formula Calculation Examples

Which Depreciation Method Is Best For You The Real Estate Conversation

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Cost Formula Calculator Examples With Excel Template

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors